Lately, I’ve been trying out different passive investing services as part of my goal to generate enough passive income to live comfortably. In a recent post I talked about my experience with goPeer, a peer-to-peer lending service that is a great way to earn passive income. In this post, I’ll share my experience with Addy, a real estate investing service. There are many of these types of services in the U.S.A. but not many in Canada so I thought I would share what I’ve learned.

What’s Addy?

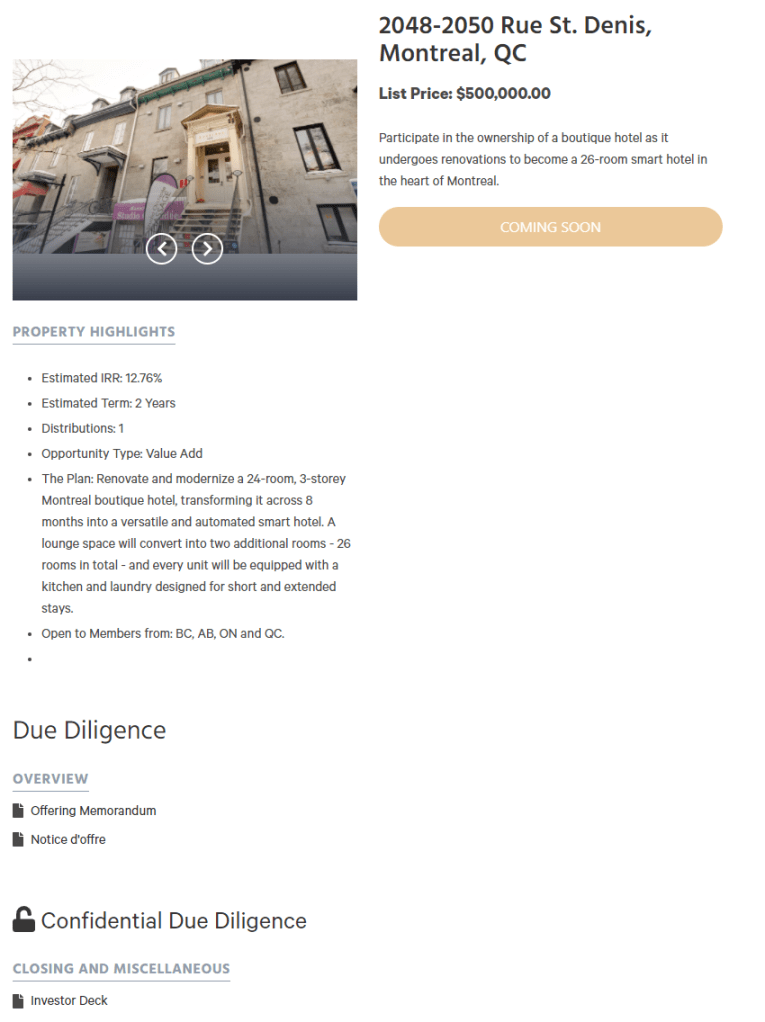

Addy is a real estate investing platform that aims to make real estate investing possible for everyone. Addy’s professional team identifies the real estate investment opportunities and does all the heavy lifting for you. You can invest as little as $1 and own a share (called units) in a boutique hotel in Montreal or campground in Lakefield. Super cool! Many of the investment opportunities offer a projected return of 12% or more.

How it works

First, you’ll need to sign-up for a membership which is $25 per year for a basic or $500 for a 5-year membership which comes with some extra benefits. I think they should do away with the membership fee upsell you once you’ve got past your first investment but that’s just me.

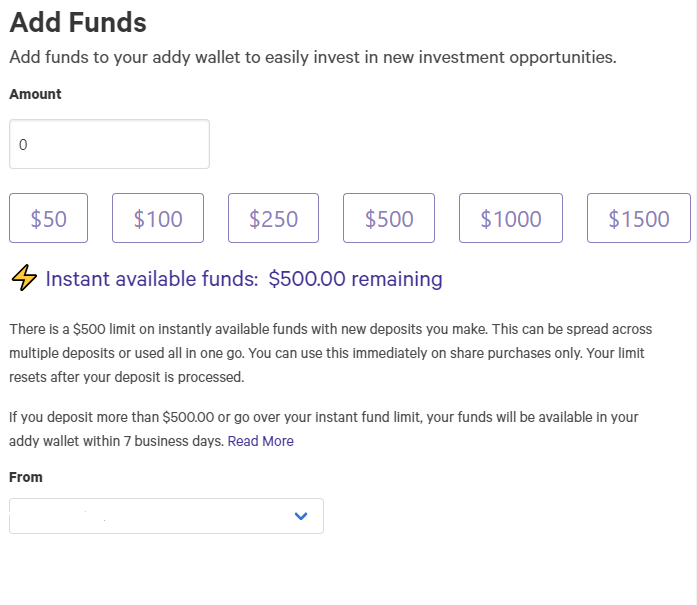

Then you will need to connect your bank account to transfer funds into your Addy wallet. This was a major sticking point for me as I’m super nervous about connecting my account so I spent a bunch of time reading up on the owners of the business, where they are located, background etc.

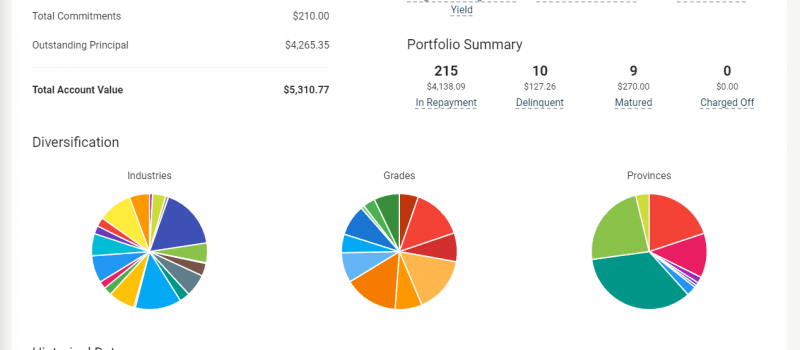

With the formalities out of the way, you will be presented with a dashboard with the usual suspects: your wallet balance, total investment, new properties etc. The property view looks like this:

From this screen, you can read more about the offer, dig into the Offering Memorandum, flip through the investor deck and if you so choose – invest in the property.

What I like (so far)

What I like so far about Addy is that you are not swamped with tons of properties to invest in and left to your own devices. Addy seems to carefully plan out each property and presents you with videos, slideshow presentations and even honest pros and cons videos. I honestly feel like I can make a fairly well-informed decision especially if I take my time to read through the very detailed offering memorandum – a 50-page document outlining all the plans, financials and potential returns.

There is something about Addy that just feels good. When I invest with Addy I feel like I’m investing in my community, city, country. Many of the projects are turning run-down buildings into low-cost rent or revitalizing an area.

So far I’ve only invested $2500 into a few properties and since my investments won’t pay off for some time I’ll probably be blogging more about my experience down the road.

If you like this summary and want to give Addy a try, please use this link. we’ll both get $25 bucks to invest in our next property!