I recently blogged about my experience with goPeer so far and I’m really enjoying the service. One thing I thought it could use though is an income projection calculator. So I created one and thought I would share it. You can find it here.

How to use the calculator:

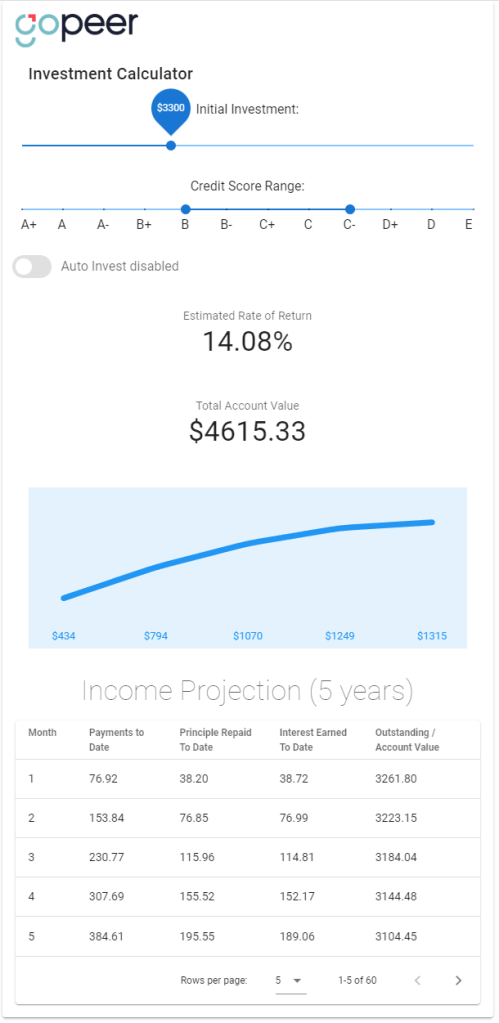

- Using the initial investment slider choose the amount you would like to invest

- Use the credit score slider to choose your minimum and maximum credit score range

- If you are going to set your account to auto-invest, enable the auto-invest slider

Understanding the output

The tool uses the statistics published by goPeer to calculate an estimated rate of return based on the credit score range you choose. Obviously, the higher-risk loans you choose to fund increase your rate of return.

The tool outputs a Total Account Value that estimates what your total balance will be at the end of 5 years. This is because goPeer allows for 3 and 5-year repayment terms. for now, the tool just assumes that all notes are 5-year terms.

The graph projects the total interest earned at the end of each year. The table below the graph shows the monthly Payments to Date which are the cumulative total payments received, Principal Repaid to Date which is the total amount of your original investment being returned to you, the Interest Earned to Date which is the cumulative total amount of interest you have been paid and finally the Outstanding Balance or Account Value which is how much of your original investment remains to be repaid.

I hope you find it useful, and please let me know if you would like any features or enhancements in the comments below.

One thought on “goPeer Investment Calculator”