One of my life goals is to generate enough passive income to live comfortably. One of the ways to generate more passive income is by taking part in a relatively newer approach to lending called peer-to-peer lending.

How it works:

As a borrower, goPeer makes it very easy to apply for a loan from the comfort of your home. You need to be 18 or older, have a credit score of at least 600 and have a regular source of income over $15k per year. Aside from that you must be a Canadian and have a Canadian bank account.

As a lender, after you sign up, you will be asked a few questions about your investment goals. Then you will be asked to connect your bank account to transfer funds into goPeer. This was the most stressful part for me. I actually wimped out a few times and decided to read more about the company and try again. I’m pretty comfortable having my money with goPeer so far. Depending on the loans you invest in you can expect Gross returns from 7.5% to 28%.

What to expect:

When you start using goPeer you will need to transfer some funds into the platform which can take about 5 days. I was pretty excited to use the platform and found myself logging in every day after my initial deposit to see if my funds were available to invest.

Once your funds are available you can start investing. This is easy to do. You will be presented with a screen like this which will let you pick and choose the loans you would like to invest in:

You can then drill down into each loan and view a summary of the loan details. This give’s you a simple, high-level view of the borrower’s income, the field of work, location, whether they own or rent, the purpose of the load, their credit score, debt ratio loan amount and so on. I found this very useful when I was starting out. The checkboxes indicate that goPeer has validated the information and the ‘!’ indicates they have not.

After I became more comfortable with the service I turned on the “auto-invest” feature. It’s pretty straightforward and well designed. You choose how much you want the feature to invest in each loan, select a range of credit risks and turn it on. The system will then invest into loans automatically with your settings every day.

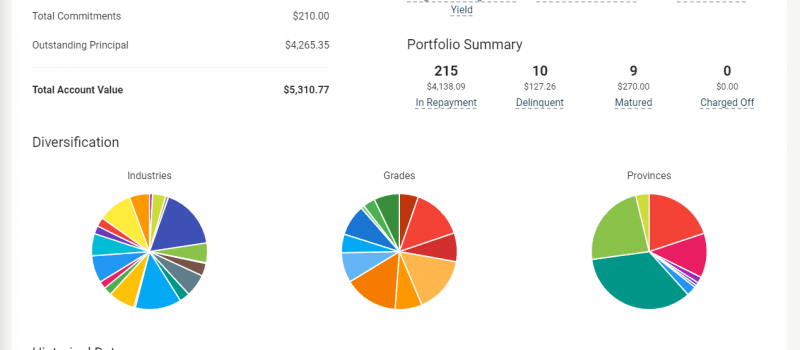

The dashboard is super clear and very user-friendly. It will give you a high-level summary of the industries, credit grades, provinces, account totals and all the high-level numbers one would expect.

I do wish they would add an income projection graph and even filed a ticket for the feature request. The support staff replied promptly, they were courteous and supportive.

update: I decided to make my own gopeer income projection calculator and blogged about it here.

Final Thoughts

goPeer says they have 4,305 investors on their platform. This is a healthy metric in my opinion because it means that you can invest a little bit into many loans on the platform which will reduce your risk of losing a bunch of money due to a borrower getting “charged out”. A term used when the borrower fails to pay their loan and is deemed unrecoverable. Everyone shares the risk.

Take your time when you start using the platform. Don’t invest too much into a single loan, spread your money around many loans and be patient. When I joined there were only a handful of loans to invest in. Avoid the temptation to overfund a loan.

goPeer also mentions that the average interest rate earned on the platform is 15.9%. That’s a pretty great return. I wish services like this existed when I was younger. The first real thing I invested in was a GIC which did not even keep up with inflation.

That’s it for now, I’ll post another update in the future with some statistics on real earnings, charge-outs etc.

Try it out for yourself! Using my referral link will help us both out: you’ll get $30 bucks and I’ll get $30.

One thought on “My experience with goPeer (so far)”